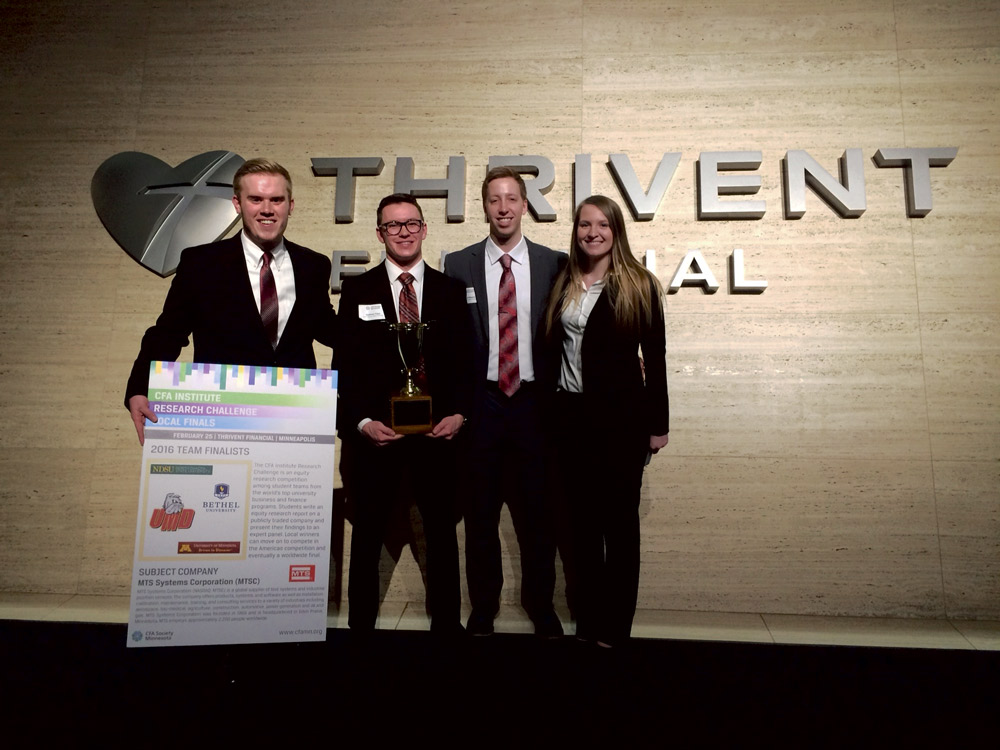

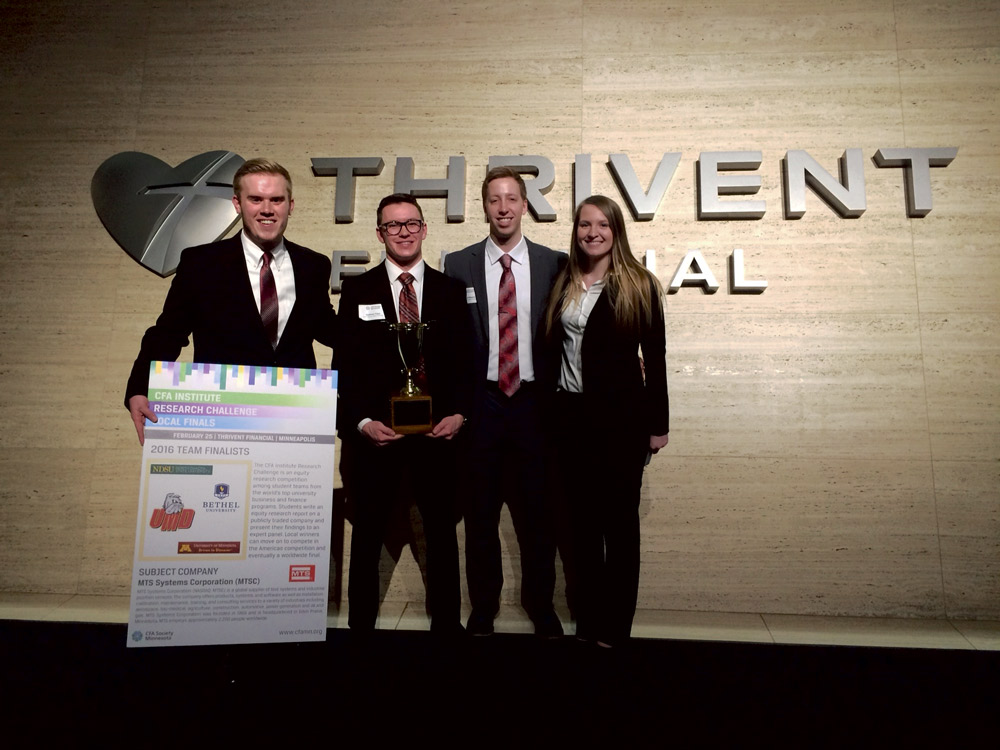

(Left to right) Mike Wulff, Matt Gapp, Matt Wegner, Katie Eckelman recently won the regional IRC financial analysis competition.

Students are infamous for not considering the factors when it comes to money, other than whether to put it in savings or checking. That isn’t the case for students in the Bison Fund.

The Bison Fund is a Student Managed Investment Fund that manages roughly $1.3 million of assets and makes investment decisions with the goal of growing the fund.

The organization also received a donation from the Larson Foundation and now has the goal of growing that fund over the next five years with the goal of developing a self-sustaining scholarship.

The organization offers a unique learning experience for those interested in business and finance. Students get to be an integral part of the process, since investment decisions are decided at the group level after discussing and analyzing the potential benefits of an investment.

“It isn’t limited to business students; anyone who is interested can be a part of the organization. You can be a biology major, as long as long as you are interested, willing to work and learn,” said Jason Churchill, a grad student studying agribusiness and applied economics. He is also the president of the Bison Fund.

Involvement offers an opportunity to learn about evaluating and analyzing companies to invest in, but it also offers an excellent opportunity for networking.

A financial analysis team consisting of four students involved with the Bison Fund recently competed and won the regional CFA Institute Research Challenge, “and now they are getting asked to come to interviews,” Churchill said.

Members from the Bison Fund take three trips per year — to Minneapolis, Chicago and New York — which serves as a great opportunity for learning and networking.

“We were in New York recently,” Churchill said, “and one of the guys handed an executive the report he had done for the IRC competition. The executive took a look at it, and told him that they had just filled all of their summer internship positions, but that if he had any open, he would give it to him on the spot.”

Seeing the competition in the Big Apple showed Churchill how well NDSU students stacked up against the national competition.

Churchill attributed some of this to the access the organization has to twelve Bloomberg machines through NDSU, which allow access to the latest financial data on companies.

“I realized how far ahead NDSU is compared to many other schools in that respect,” Churchill said. “Still, we aren’t at the top. There is always room for improvement. With a new Business Dean coming in, we are hopeful that they will recognize how much potential the Bison Fund has.”

The organization has goals to become more visible in the F-M area and on a larger scale. They are planning on revamping their website to display the caliber of work that they are producing and to share their analyses of companies with a wider audience.

“Additionally, we are working on putting together an ‘industry advisory board,’ to connect the FM finance community with the Bison Fund. They can give us guidance, and it also offers an opportunity for networking,” Churchill said.

NDSU has been turning out high-caliber business students, and the Bison Fund is one way to showcase the talent. Students interested in the Bison Fund can contact Churchill or Fariz Huseynov, assistant professor of finance and adviser to the organization.